I've been working a little on market research over the last few weeks. In particular I've applied asymptotic mathematics and some rudimentary statistics to analyze market trends. And what I've found has been very interesting to say the least.

To begin with, I plotted the growth in overall global GDP for the last two thousand years, and after playing around with the data, I was able to settle on a highly correlated growth curve: O(eex/x/x)

For those who don't know, O(f(x)) is known as the "Big-Oh", and specifies that a function f(x) grows no faster than a certain upper bound.

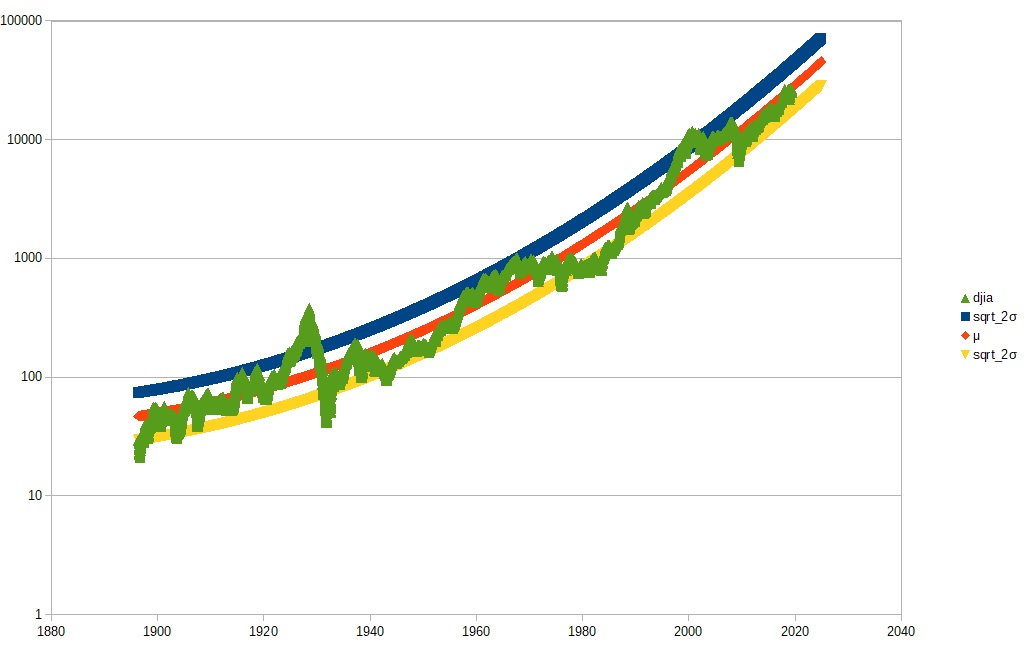

My theory, which I've been testing, is that far from being efficient, as capitalist folklore has suggested, markets are actually highly inefficient, and very poor at price evaluation. Market prices grow at a rate outpacing overall wealth generation, and then crash to below that threshold when realization dawns that goods are overpriced.

I was able from the growth in GDP to integrate the function with respect to x, in order to find an upper bound on the accumulation of wealth. I assumed GDP was the derivative of global wealth, and this turned out to be a fairly accurate assumption. Global wealth grows at a rate of O(eex/x-x) if the calculus holds.

When I corrected the data of the stock market since 1896 for the above function, I was able to arrive at near perfect correlation over time. The stock market accelerated to above the curve, then crashed to below it, before recovering, stabilizing, and starting the process all over again.

Next, I investigated both bull and bear markets, trying to find some form of correlation between the data points. After trying many different combinations, I found surprising correlation with one function in particular. Both Bull and Bear markets were bounded by the functions O(xex2) and o(xe-x2) respectively.

These were such rapidly changing functions that they made the 6-year economic cycle make a lot of sense. A particularly aggressive bull or bear market can stray far from the wealth curve in a matter of months, weeks, or even days.

My next step is to apply what I've learned to both market prediction and market simulation, provided I have the time.

Thank you for reading this update!

_____________________________________________________________________

RECAP:

WORLD GDP: O(eex/x/x)

WORLD WEALTH: O(eex/x-x)

BULL MARKET: O(xex2)

BEAR MARKET: o(xe-x2)

_____________________________________________________________________

Add new comment